Guidelines for opening bank account. An account with a bank or other financial organization that keeps track of your deposits, withdrawals, and transfers with the bank is called a bank account. Money is stored safely in accounts, which come in several varieties. Savings accounts are used to save and generate interest, while current (or checking) accounts are used for everyday activities like bill payment. Other varieties with distinct functions include corporate accounts, domiciliary accounts, and fixed deposit accounts.

GUIDELINES FOR OPENING BANK ACCOUNT

A valid ID (such as a driver’s license, national ID, or foreign passport), proof of address (such as a utility bill), and the account opening form must be filled out in order to open a bank account in Nigeria. Two passport photos, two reference forms, and a Bank Verification Number (BVN) are also required. An initial deposit or other particular paperwork may be required by certain institutions. To open a business bank account, you will need:

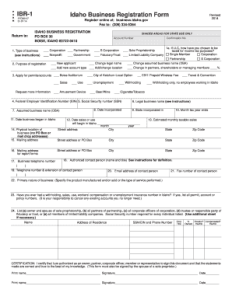

1. Business registration documents;

If the bank request it, you must produce documentation proving the company’s business registration, such as a certificate of incorporation, a business name registration certificate, or any other pertinent paperwork.

2. Tax identification number;

In Nigeria, a Tax identification Number is required for all businesses in order to open a bank account. For tax purposes, the federal inland revenue service issues this number.

3. Business address:

GUIDELINES FOR OPENING BANK ACCOUNT

The business’s address, including its physical location, mailing address, and phone number, must be given to the bank.

4. Directors or shareholders information:

You could be required to submit information on the company’s directors, shareholders, or partners, depending on the kind of business structure. This can include a valid international passport of drivers license, the shareholders passport photos, the bank holding company, the waste management authority Lawma bill, and so on.

5. Initial deposit;

GUIDELINES FOR OPENING BANK ACCOUNT

To open a business bank account, the majority of banks need an initial deposit. Depending on the bank and kind of account you’re opening, this sum may change

Why Do You Need A Business Account for your business?

1. To show professionalism:

Customers can see how committed you are to running your business by looking at your business bank account. You convey to everyone that you mean business when, during a transaction, your business name appears instead of your personal name.

2. To build trust with your customers;

GUIDELINES FOR OPENING BANK ACCOUNT

A corporate bank account boosts credibility with clients. Transferring funds to a company account is considered more secure than to a personal one.

3. To build credit and access loans: Every business would require a loan at some point.

Because of this, one of the prerequisites for getting a big loan is having a business account with a track record of promptly repaying earlier, smaller loans. You can obtain the loan you require to grow and expand your firm swiftly if it has a solid track record.

4. To get more control over your money;

GUIDELINES FOR OPENING BANK ACCOUNT

You can keep your personal and professional finances apart with a business account. You can monitor Your cash flow and make better financial decisions with this specialized account.

Summary

You typically require your Social Security number (or equivalent identity number), evidence of residence address, and a government-issued photo ID in order to create a bank account. A completed application, an initial deposit, and a passport photo might also be required by certain institutions.